Tax Table 2024 Philippines Monthly – Try our fast, hassle-free tax filing. It’s just $50. There are seven federal income tax brackets for 2024. Your tax rate is determined by your income and tax filing status. Many or all of the . The Philippines is the borrower of this policy-based loan for DRM reform. This DRM program addresses the country’s need to tackle discrepancies in tax policy frameworks to boost tax compliance .

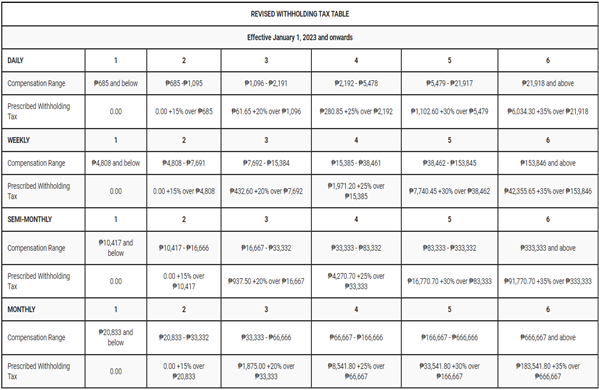

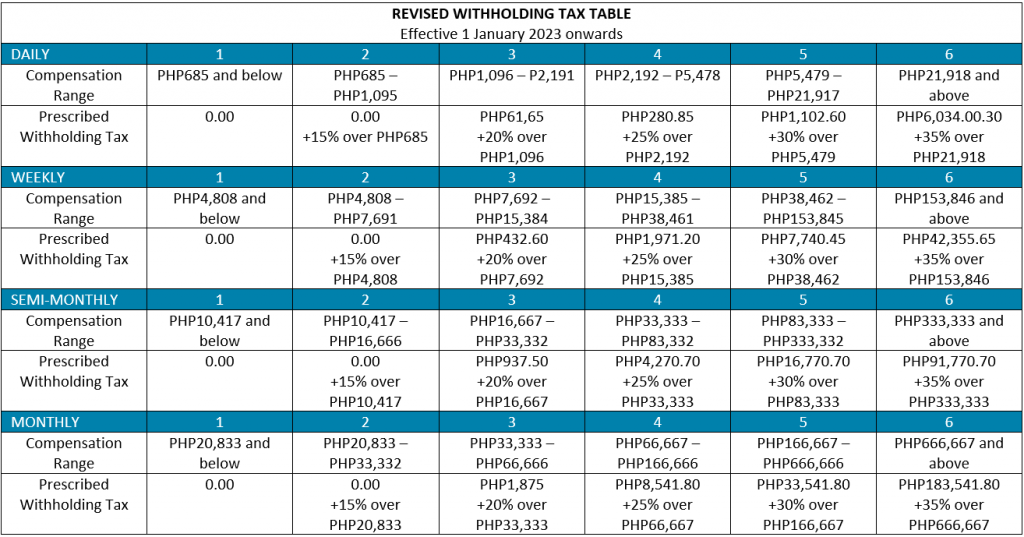

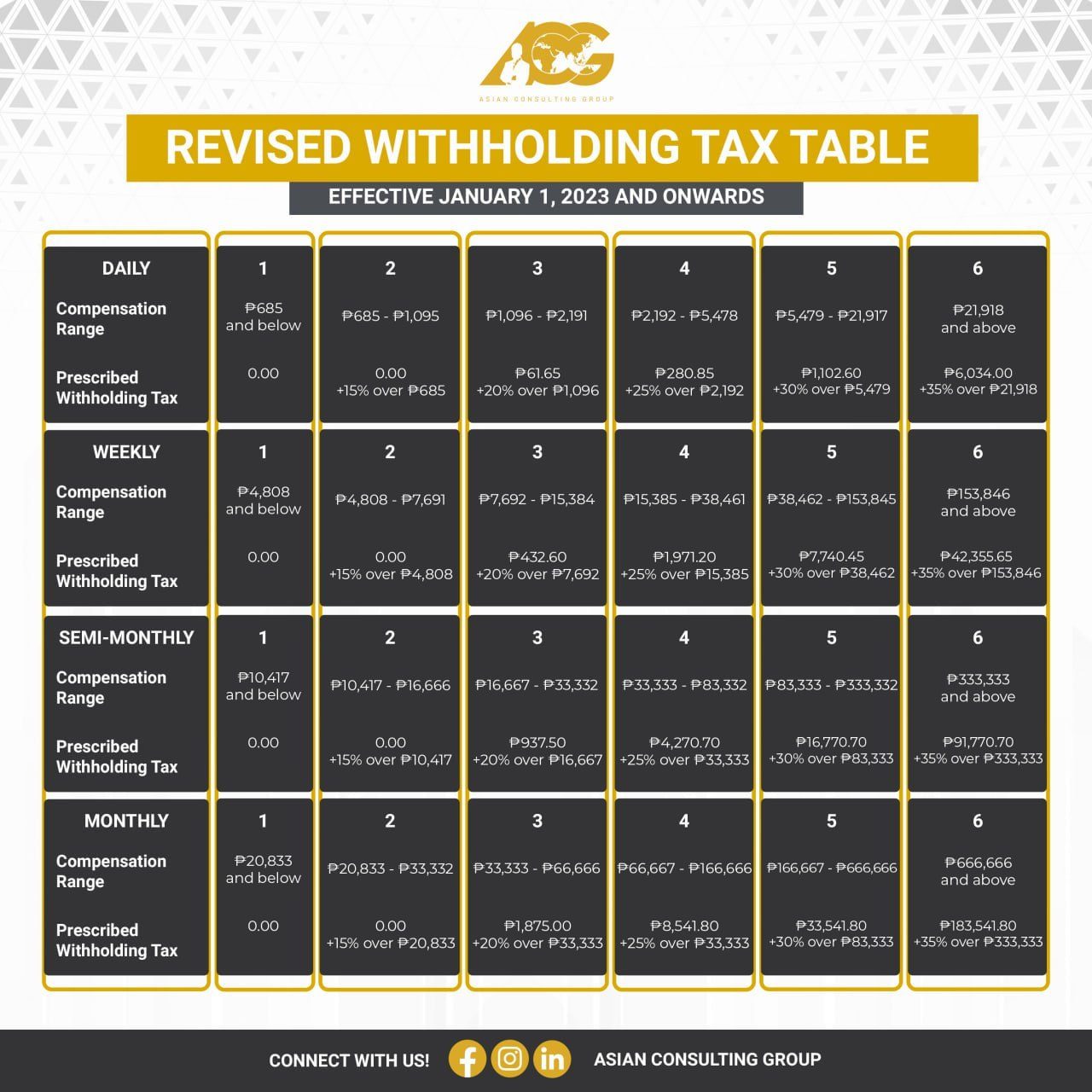

Tax Table 2024 Philippines Monthly

Source : www.micoope.com.gt

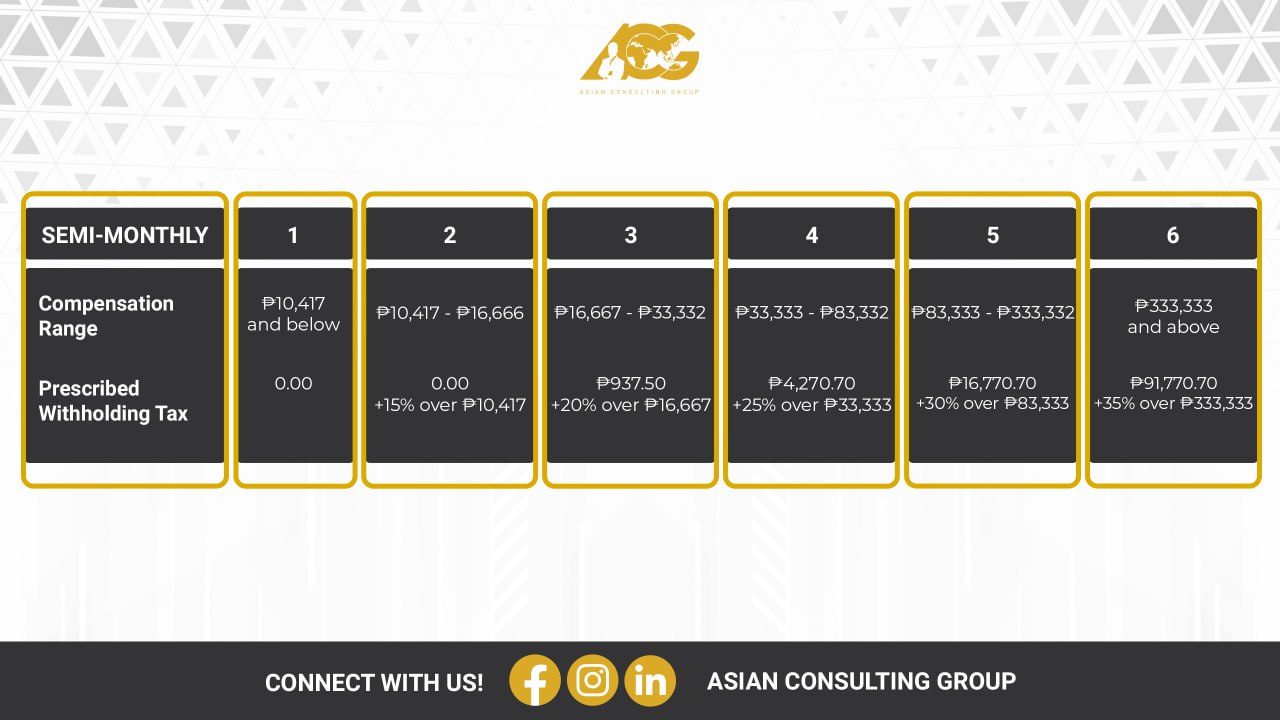

Philippines TRAIN Series Part 4: Amendments To Withholding Tax

Source : conventuslaw.com

TRAIN Series Part 4: Amendments to Withholding Tax Regulations

Source : www.zicolaw.com

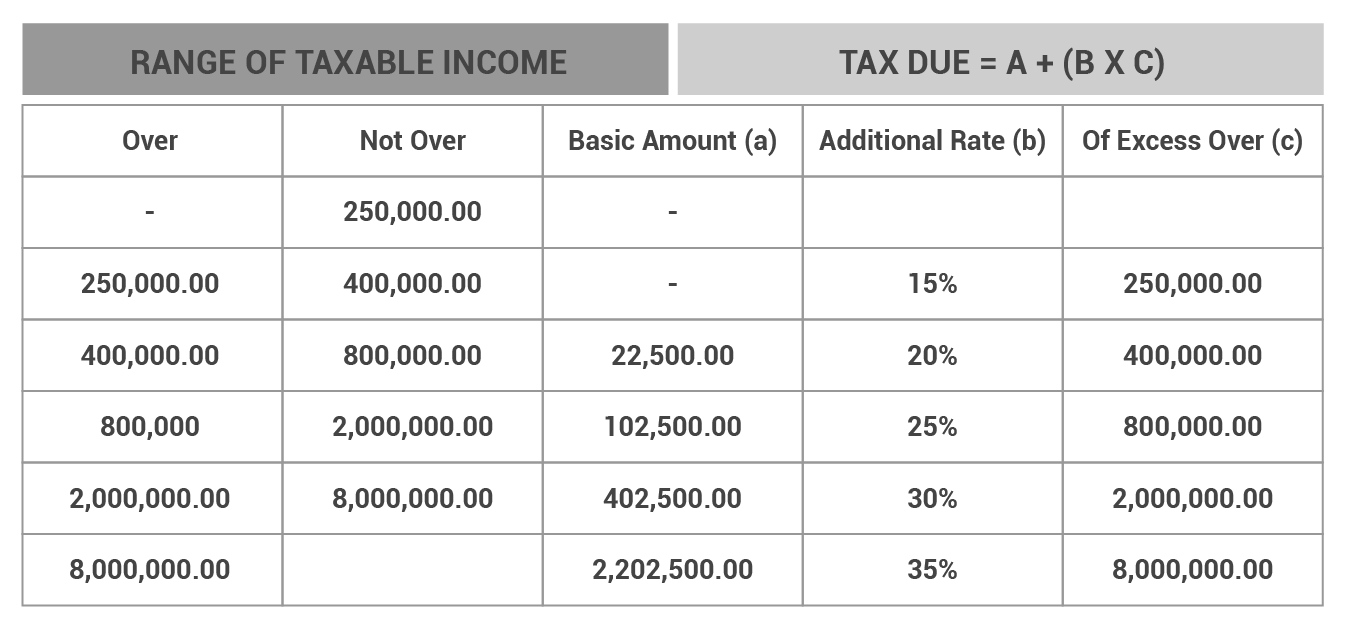

Ask the Tax Whiz] How to compute income tax under the new income

Source : www.rappler.com

Income Tax Philippines Calculator

Source : www.omnicalculator.com

Ask the Tax Whiz] How to compute income tax under the new income

Source : www.rappler.com

Tax, SSS, and PHIC Updates for 2023 | InCorp Philippines

Source : kittelsoncarpo.com

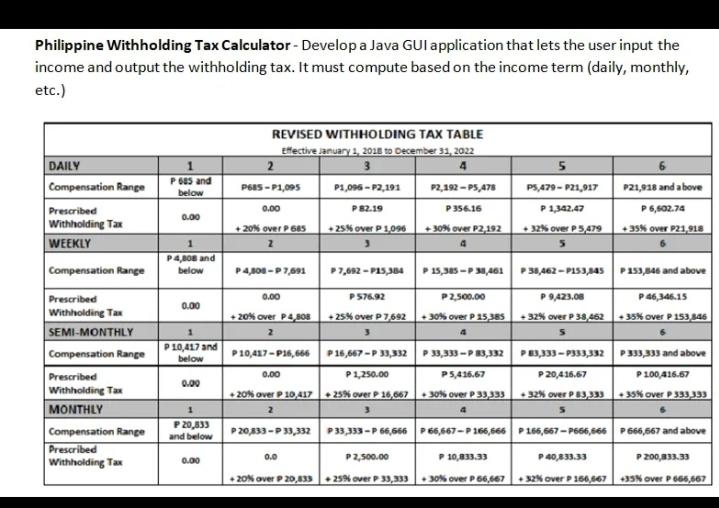

Revised Withholding Tax Table | Bureau of Internal Revenue

Source : governmentph.com

Solved Philippine Withholding Tax Calculator Develop a | Chegg.com

Source : www.chegg.com

How To Compute Income Tax Philippines: An Ultimate Guide FilipiKnow

Source : filipiknow.net

Tax Table 2024 Philippines Monthly WIthholding Tax Using Compensation Tax Table| TAXGURO, 48% OFF: For example, California tax brackets for 2023-2024 are similar to IRS brackets, although California has nine brackets ranging from 1% to 12.3%. Your marginal tax rate refers to the percentage paid . These are the taxes you’ll file in 2024. We’re happy to report there If you choose to file by mail, the IRS warns it could take six months or more to process your return. .